Will 2017 be the year of regulation of the blockchain?

On July 26, 2017, the US Commission on Exchanges and Securities (SEC) recognized the ICO as an issue of securities. Now, the process of issuing and selling cryptographic tokens of the project, according to American legislative practice, is equated with operations with securities. A day earlier, the SEC presented a newsletter on the nuances of ICO and possible risks for investors. In the Wirex payment blockchain service team , we present to readers of Geektimes a chronology of regulation of the cryptocurrency market and solutions based on distributed registry technology.

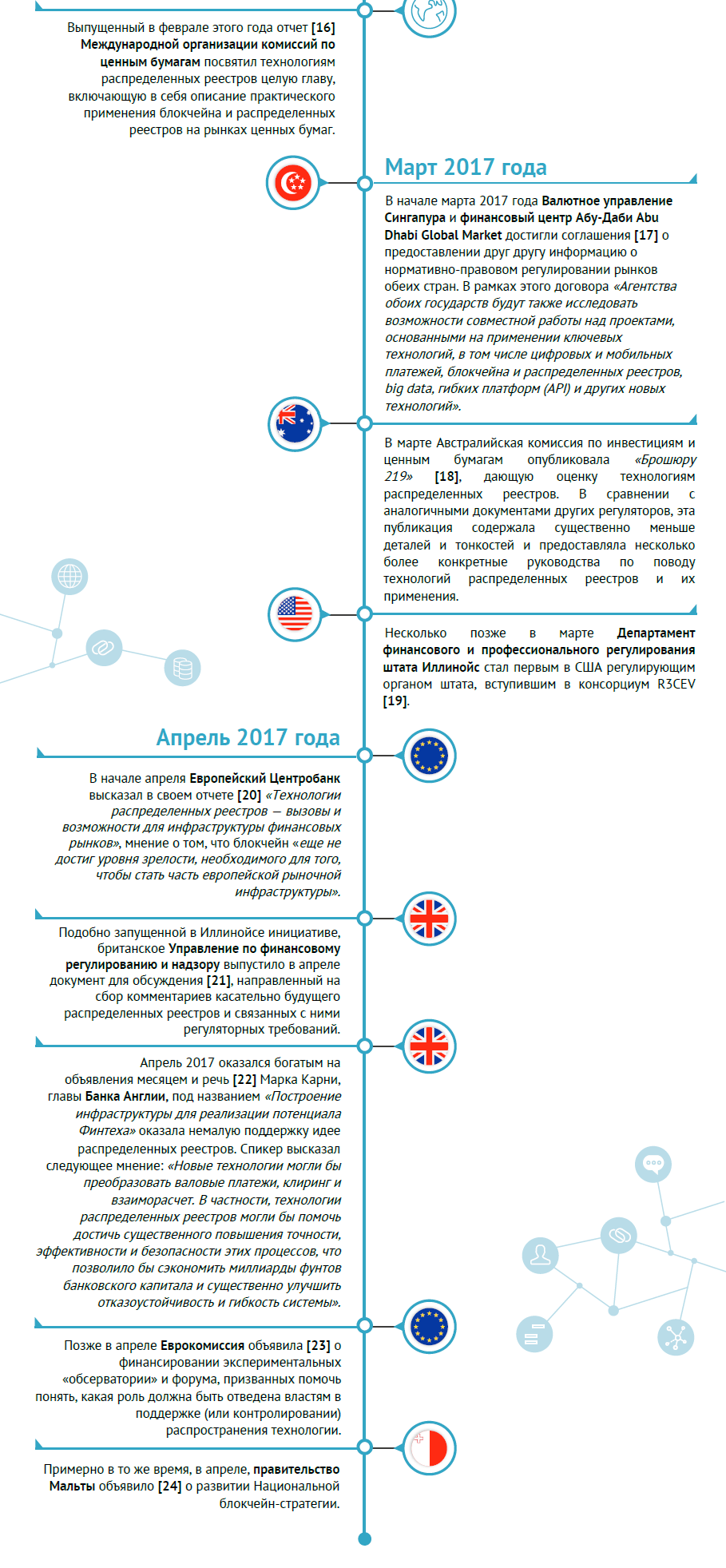

When regulators begin to show significant interest in any area, they gradually begin to attempt to regulate it “just in case”. A similar situation may occur in the case of blockchain technologies, taking into account the interest expressed by state control bodies around the world seeking to “better understand the technology”.

This material presents a summary of official statements by regulatory authorities from around the world on the blockchain technology.

So will supervisors demand blockchain regulation?

Developments can take a very interesting course, since government agencies, as a rule, do not supervise technology as such, but choose to regulate how it is applied.

A typical example is the fact that regulators do not control the use of Microsoft Excel or Oracle databases, but oversee the processes and procedures in which these technologies are applied. For this reason, it is possible that regulators will take the same approach in this segment, or resort to aggressive policies and declare that the blockchain, distributed registries and smart contracts are systemic risks.

In the case of the implementation of the latter scenario, we are likely to see the strengthening of regulatory arbitration, with the result that some organizations may decide to make appropriate changes to their technology platform or business operations in such a way that they allow them to operate effectively under the existing regulatory regime .

Links

[1]

FSOC Annual Report 2016[2]

Financial Stability Board Seeks 'Better Understanding' of Blockchain Tech[3]

Financial Stability Board agrees 2017 workplan[4]

Special Address of the CFTC Commissioner J. Christopher Giancarlo Before the Depository 2016 Blockchain Symposium[5]

Keynote Address at the SEC-Rock Center for Corporate Governance Silicon Valley Initiative[6]

Discussion Paper. The Distributed Ledger Technology Applied to Securities Markets[7]

esma official website[8]

Financial Conduct Authority of Project Innovate[9]

State of Illinois: Request for Information (RFI)[10]

MAS, R3 and Financial Institutions experimenting with Blockchain Technology[11]

Distributed Ledger Technology: ECB role and relevance[12]

ECB and Bank of Japan research DLT for market infrastructure[13]

Distributed ledger technology in payments, clearing, andsettlement[14]

Distributed Ledger Technology for the Securities Industry[15]

Hong Kong Regulator Joins R3 for Blockchain Tests[16]

IOSCO Research Report on Financial Technologies (Fintech)[17]

Monetary Authority of Singapore and Abu Dhabi Global Market Activities[18]

Evaluating distributed ledger technology[19]

Illinois becomes ledger group distributed to R3 distributed ledger group[20]

DLT still not mature enough says ECB[21]

DP17 / 3: Discussion Paper on distributed ledger technology[22]

FinTech's Promise Building the Infrastructure to Realize[23]

EU plans for blockchain 'observatory' raise concerns, says expert[24]

Malta's National Blockchain Strategy

Source: https://habr.com/ru/post/405509/

All Articles